- Neo Bank

Blockchain Secure

Experience seamless integration of traditional finance and cryptocurrency in one powerful, mobile-first neo banking platform.

Assets Protected

Active Users

Countries

Security Monitoring

- Key Feature

Complete Financial Needs In One App

Your assets are protected by the most advanced security systems in the industry

Payment Support

Supports All Payment Types

High Security

Military Grade Blockchain

- Encryption

- OTP-Message

100% Digital

Perfect Ease and Control

- Apple

- Android

- About Us

Let's Make Your Finance Activity Go Digital

At GUARDIIAN Neo Bank, we understand the future of banking is digital, secure, and borderless. As a next-generation Neo Bank and Crypto Neobank, our mission is to help redefine how people manage, invest, and grow their money in today’s fast-moving digital economy.

We combine the reliability of traditional banking with the innovation of blockchain and crypto solutions—offering you a seamless, secure, and intelligent financial experience. Whether you’re looking to simplify your everyday transactions, explore crypto banking, or manage your global finances, GUARDIIAN Neo Bank is your trusted partner.

- Digital-first banking

- Security & trust

- Crypto integration

- Global access

- Why Choose Us

We Commit To Give You The Best Experience

Neobanks offer several advantages over traditional banks, making them an attractive option for many consumers. Some of the key benefits of using neobanks include:

Lower Fees

Neobanks cut unnecessary costs by reducing or eliminating overdraft, ATM, and maintenance fees—helping customers save significantly compared to traditional banks.

Higher Interest Rates

With higher interest rates on savings and deposits, neobanks let customers grow their money faster than traditional banks through high-yield savings accounts.

Increased Accessibility

Neobanks provide 24/7 access through mobile apps and online platforms, making banking simple, convenient, and borderless—unlike limited traditional bank hours and branches.

Improved Customer Service

With real-time chat, intuitive apps, and user-friendly experiences, neobanks deliver faster, personalized, and more efficient customer service than conventional banking systems.

Financial Inclusion

By offering services to underserved and remote populations, neobanks expand financial access, empowering low-income individuals with modern digital banking opportunities.

- Our Services

Our Latest Technology & Interesting Features

We are behind you getting in front of life’s curve.

Smart Crypto Exchange

AI-powered trading with institutional-grade security protocols and minimal fees.

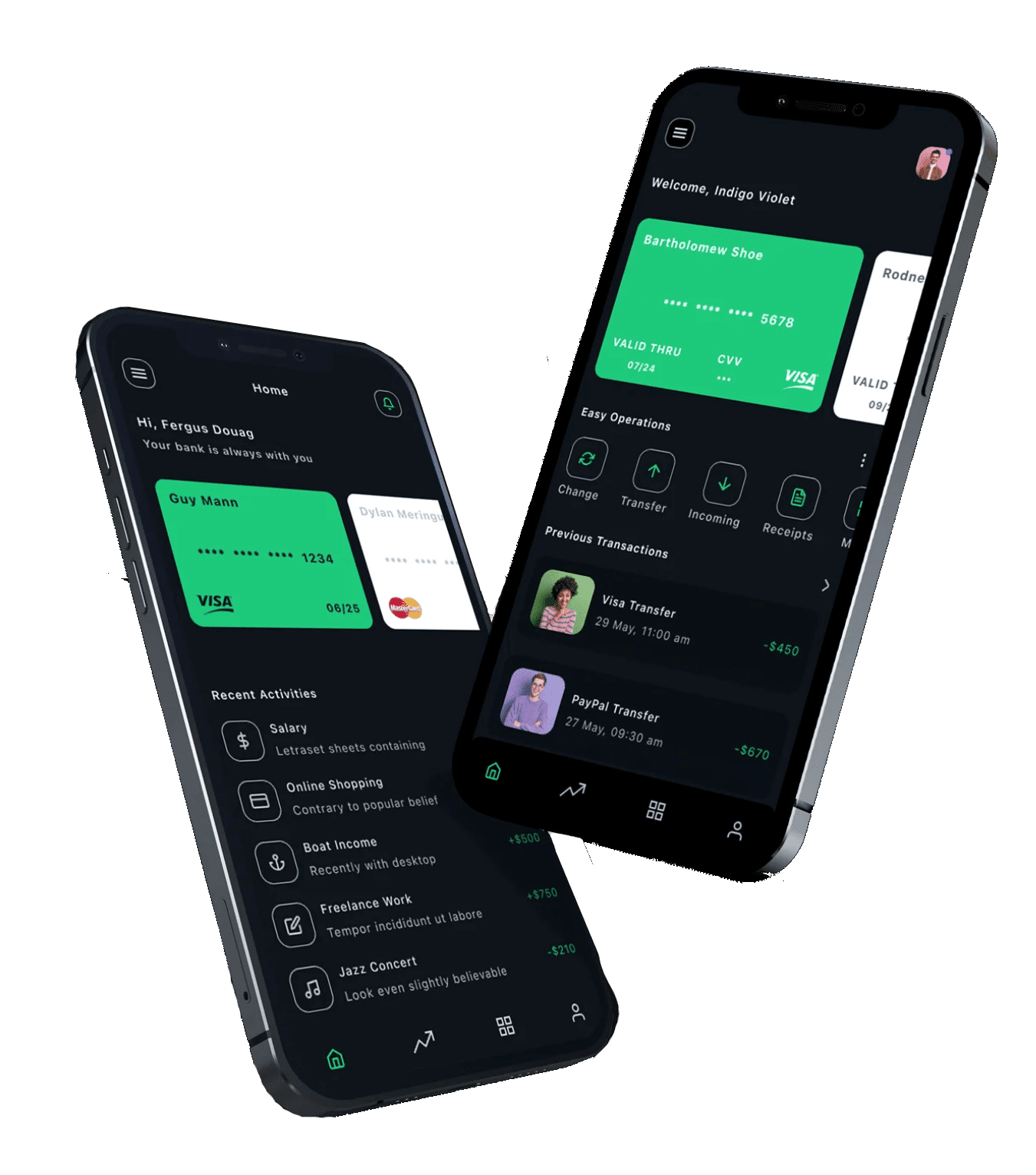

GUARDIIAN Mobile App

Complete banking control with biometric authentication and real-time threat detection.

GUARDIIAN Card

Smart debit card with dynamic CVV, transaction limits, and instant freeze capabilities.

Global Payments Network

Send and receive funds worldwide with real-time tracking and military-grade encryption.

DeFi Integration

Access decentralized finance with institutional-level security and insurance protection.

Advanced Security Suite

Multi-signature wallets, cold storage, and 24/7 monitoring by our security team.

- FAQ's

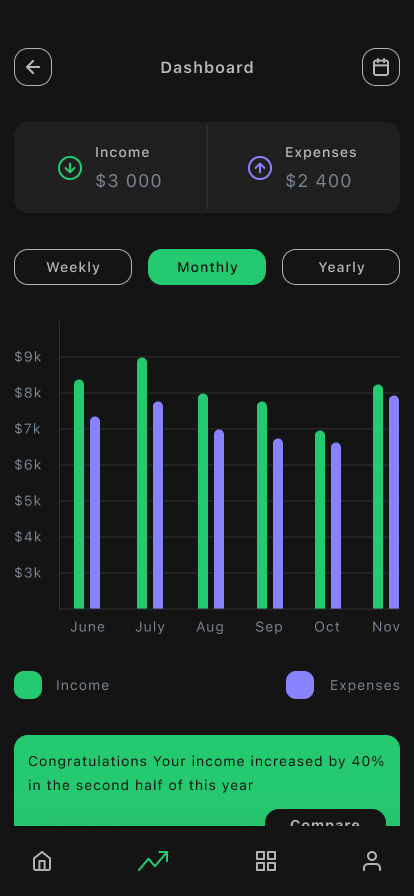

Easy Way to Manage and Convert Your Income

Everything you need to know about NeoBank

Neobanks, also known as digital banks, are financial institutions that operate solely online, without any physical branches. They offer all of the same banking services as traditional banks, but with the added convenience of being accessible from a mobile device or computer.

Neobanks differ from traditional banks in several key ways. Firstly, they operate without physical branches, which allows them to offer lower fees and higher interest rates on savings accounts. This branchless model reduces overhead costs, enabling neobanks to pass on the savings to their customers. Secondly, neobanks prioritize user experience, offering intuitive mobile apps and online platforms that make it easy for customers to manage their accounts and access financial services anytime, anywhere. Lastly, many neobanks partner with traditional banks to provide FDIC insurance and other essential financial services, ensuring that customers receive a comprehensive range of products and services while enjoying the benefits of digital banking.

Yes. We employ bank-level security measures including 256-bit encryption, multi-factor authentication, and biometric verification. Fiat deposits are insured up to regulatory limits, and cryptocurrencies are stored primarily in cold storage with comprehensive insurance coverage.

We support all major fiat currencies (USD, EUR, GBP, etc.) and a growing selection of cryptocurrencies including Bitcoin, Ethereum, and other established digital assets. Our currency support is continuously expanding based on user demand and regulatory compliance.

We're currently in our final development phase and plan to launch in select markets by Q2 2024. Join our waitlist to get early access and be notified when we launch in your region.

How It Works

Getting started with NeoBank is simple and straightforward

1

Sign Up

Download the app and create your account in minutes with our streamlined verification process.

2

Fund Your Account

Add funds via bank transfer, card payment, or directly deposit cryptocurrencies.

3

Start Banking

Access all features - spend, save, invest, and exchange with our intuitive interface.

- Download Now

Download and Register From The Mobile App

Step into the future of banking with GUARDIIAN Neo Bank, a leading crypto neobank designed for modern users. Seamlessly manage your finances, send and receive money, and explore crypto investments—all from the convenience of your mobile device.

- Download Now

Get Ready To Have The Best Smart ContractsAvailable To Date

GUARDIIAN Neo Bank is redefining the future of finance. As a cutting-edge crypto neobank and neo bank, we combine the convenience of digital banking with the innovation of cryptocurrency integration.

Join The GUARDIIAN Neo Bank

Be among the first to experience the future of finance. Sign up for early access and exclusive benefits.

© 2025 GUARDIIAN Neo Bank